Media Release — Auckland, 25 August 2022

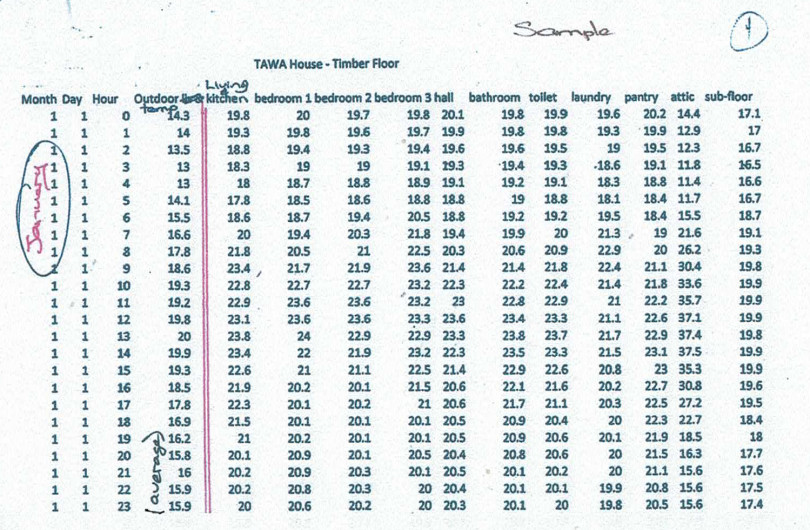

The 2022 EBOSS Construction Supply Chain Q3 Update highlights that while some pressures impacting the market appear to be improving, the price of building products sold in New Zealand has increased 32% on average over the last 12 months, and suppliers are predicting a further rise of 9% over the next 6 months.

Matthew Duder, the Managing Director of EBOSS says that construction costs for new homes are set to increase further despite demand beginning to soften, with continuing international cost increases and pressure to have more product on hand leaving building product suppliers taking on even more risk.

“The 2022 EBOSS Construction Supply Chain Q3 Update shows that the New Zealand building industry is still facing significant challenges when it comes to the cost and supply of building materials,” he says.

“Almost all suppliers (95%) report that rising freight costs are creating inflationary pressures on their business, while 63% say this increased cost is impacting their ability to supply the market — down just 4% from July 2021. And while global supply chain issues have eased a little, 83% still say they are experiencing international freight issues,” says Duder. “Add to that rising overseas material costs — the biggest inflationary pressure cited by suppliers — and the cost of New Zealand building products has nowhere to go but up.”

Duder adds that the New Zealand building industry is heavily dependent on international supply with 90% of building products either sourced as finished products or reliant on components from overseas.

“It is unsurprising then that while domestic pressures begin to ease — 21% fewer suppliers cited delays at domestic ports as an issue compared to July 2021 — it is really international factors that are controlling the ability to supply affordable products to the NZ market.”

While the 2022 Q1 survey saw suppliers predicting that they would raise product prices to match any increases in buy-in costs they themselves face, Duder says the EBOSS Construction Supply Chain Q3 Update shows that on average sell prices have increased 4% less than buy costs over the last six months.

“Suppliers of structural products are feeling the strain, having taken on a 45% increase in the cost of their products on average over the past year, while only having increased their sale price by 33%,” says Duder. “This discrepancy, paired with an increase in stock holdings of 46% on average across the board risks the stability and solvency of building product supply companies across New Zealand.”

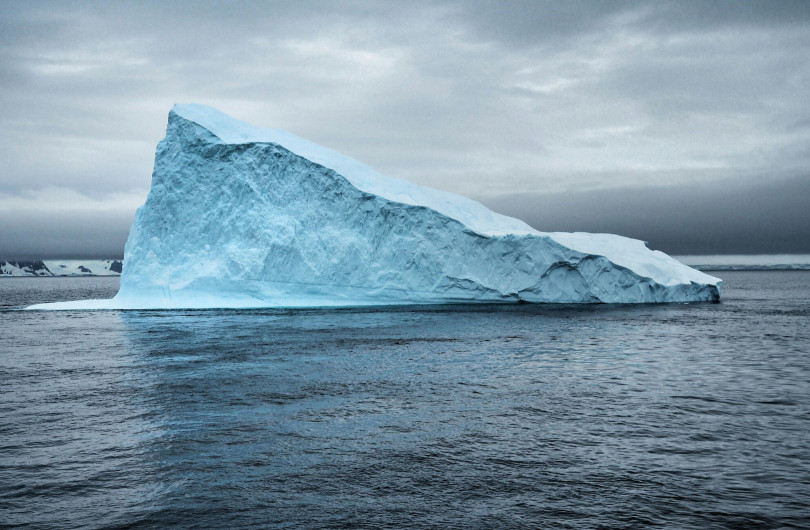

Duder notes that ultimately, the EBOSS 2022 Construction Supply Chain Q3 Report paints a picture of an industry that is caught between the pressure of continued cost increases to freight and product costs internationally and a domestic market that is showing signs of slowing.

“With many suppliers now holding significantly more stock, and not yet having passed on full cost increases to their customers, they are taking on additional financial strain which, if not resolved, could cause issues further down the line.”

2022 EBOSS Construction Supply Chain Q3 Update Key Findings:

Logistics:

- Supply chain disruptions have reduced nearly 20% in the past year yet 64% of suppliers are still having issues meeting market demand.

- Suppliers of structural products (steel, timber etc.) have seen no improvement over the last 12 months with 78% still having issues supplying the market — the exact same figure as July 2021.

- 83% of suppliers say they are still experiencing freight issues.

- 63% say increased cost of freight is impacting their ability to supply the market — down just 4% from July 2021.

- The next biggest factors impacting supply are increased cost of imported materials (reported by 58%), international freight lead times (reported by 52%) and international freight availability (reported by 45%).

Local factors:

- 22% say increased domestic demand is impacting their ability to supply — down 21% from July 2021.

- 41% say delays at NZ ports are having an impact — down 21% from July 2021.

Product cost increases:

- The price of building products sold in NZ has increased 32% on average over the last 12 months.

- Suppliers predict that building product prices will increase a further 9% over the next 6 months.

- 95% of suppliers state that an increase in freight costs is creating inflationary pressure on their business.

- 87% say that increases in the cost of materials are creating inflationary pressure on their business.

- 39% cite material costs increases and 38% cite freight costs increases as the single biggest inflationary pressure on their business.

Narrowing margins:

- 94% of suppliers say the cost they buy at has increased over the last twelve months.

- Over the last 6 months, the average increase to material buy-in costs was 16%, yet materials sold to the market increased only 12%.

- Over the last 12 months the average buy-in cost of Structure materials was 45%, yet the sell price of Structure products was only increased by 33%.

Stock holdings:

- 71% of suppliers say they have increased their stock holdings and inventory from 6 months ago.

- On average, suppliers have increased their stock holdings by 46%.

The Q3 survey of 154 suppliers, conducted by EBOSS, is part of a six-monthly research series that aims to provide an update on the current and future state of the building product supply chain and help developers, architects and builders to better plan ahead.

Most Popular

Most Popular Popular Products

Popular Products