1

As Managing Director of EBOSS Matthew is close to trends and developments that reveal insight into the future of the NZ building industry.

You are using an outdated browser version not supported by this website.

Click here to upgrade your browser

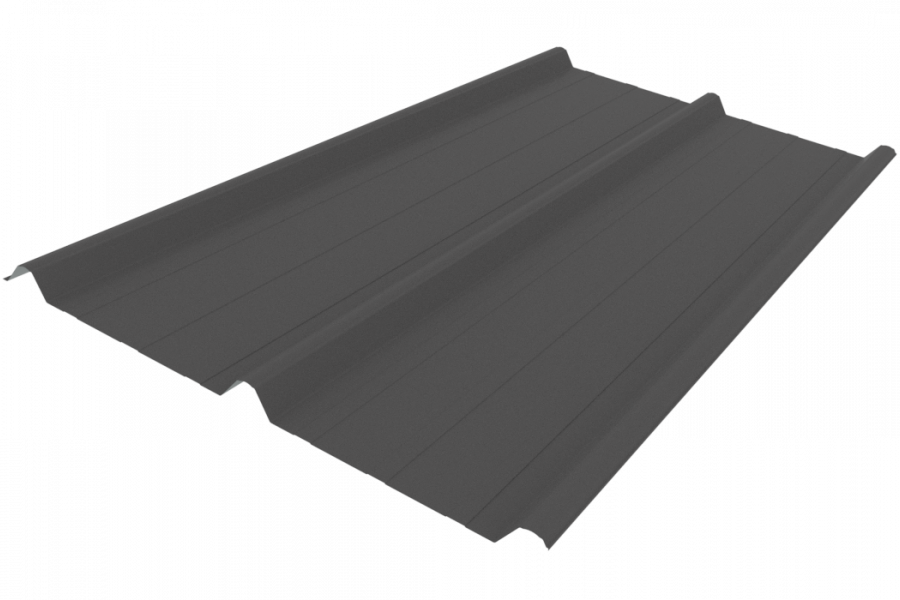

5,250 products with technical literature, drawings and more from leading suppliers of NZ architectural materials.

Case studies, new products and product news from leading suppliers of NZ architectural materials.

Blogs for architectural specifiers, offering product, design and business advice.

Library

Library

Brands A–Z

Brands A–Z

EBOSSNOW

EBOSSNOW

Detailed

Detailed

Account

Account

As Managing Director of EBOSS Matthew is close to trends and developments that reveal insight into the future of the NZ building industry.

It is estimated that up to 900 homes could be brought to market early, due to the new RDU which aims to de-risk large developments by underwriting construction of residential developments of 30+ homes.

New industry research using Certified Builders house designs has shown that the cost of the new H1 building regulations is far lower than has been reported.

Whilst the media-grabbing headlines of our Architect and Builder Sentiment Reports released in August were of falling demand, increased capacity and expected headwinds for the next 12 months, I wanted to move past these top-level soundbites and share five observations that struck me while pouring through the results of these two reports.

Many missed the release in April by Statistics NZ which calculated 43,200 homes received council sign-off (CCC) in 2023. This was a 20% increase on the number of homes completed in 2022, and was the result of the long tail of the 50,000 consent approvals in 2021/22 delivering high levels of building site activity and building product sales into the fourth quarter of 2023. Delve deeper and the data reveals far more about how we’re building and what has to change to meet the increasing demand for homes in New Zealand.

7 encouraging factors to support your conversations with clients who are considering the timing of when they should build (and why 2025/26 is an excellent window for building).

Next year will be the biggest election year in history. 2bn people in more than 70 countries go to the polls in 2024, starting with Taiwan in January through to the US presidential election in November. And the one thing that will likely dominate in all of them? The economy.

If we don’t support a younger, less experienced workforce, do we risk reducing the efficiency and quality of our built environment?

Our most recent Supply Chain Update was released this month. While it was welcome news to hear 80% of survey respondents report a resolution to supply chain issues, our findings have confirmed two new challenges set to test building product suppliers into 2024.

AI, and now more specifically, Generative AI is undoubtedly the talk of the town. Here I look at four of the key benefits and opportunities AI could bring to the construction sector.

Amongst the uncertainty of the current economic outlook, here’s some positivity to focus on.

New and updated architectural products, design solutions, inspiration, technical advice and more when you sign up for EBOSS.

Most Popular

Most Popular Popular Products

Popular Products